The Waves Framework

A first attempt to map the relationship between Strategy and Execution

A False Dichotomy

Peter Drucker was famous, amongst many business-oriented things, for articulating that “Culture eats strategy for breakfast”. In the more recent years since this proclamation, I’ve seen the possibly apocryphal aphorism morph into something akin to “EXECUTION eats strategy for breakfast”. This is not all that surprising given the present fetishization of efficiency, nor is it surprising since our species has an unfortunate congenital bias for (falsely) dichotomizing nearly everything.

Strategy and execution are not, in fact, two sides of a dichotomy; they are better represented as an AND rather than OR function. Most would acknowledge this fact in more grounded, non-Twitter conversations, but even then, acknowledging that companies must be great at both strategy and execution is not altogether interesting. No, what requires more robust scholarship in my eyes is the conditions under which each is more useful. This is a running theme the past few weeks -- that explorations of behavior in the absence of environment are fraught at best.

This is not (yet) that piece of robust scholarship, but it is a starting point for a framework I’ve been noodling on for a while that’s still quite rough around the edges. This piece will thus be different in that I’m presenting my foundational thinking for this potentially new framework before it’s fully formed. Let’s see how it goes!

The Temporal Relationship

Execution intuitively feels much more important because it represents, over a long enough time horizon, the vast majority of total time and resources -- say 95%. Purely in terms of resource allocation, then, execution is far more costly. All things being equal, this is a pretty unassailable truth.

But all things aren’t equal here, for what exactly are we executing? Whether implicit or explicit; whether soundly created or shoddy; all execution is built on top of a strategy. That 5% of resources often represents the “one-way door decisions” that Amazon popularized -- the no walking it back, unassailable decisions. This is not to say that execution decisions don’t have similar one-way door characteristics, but they are (a) less frequent and (b) most typically “lower leverage”. By leverage here I’m loosely referring to the percent of resources anchored to a given decision:

A given execution decision will rarely exceed 1-10% of resources.

A given strategic decision may in fact impact the entire 95% of resources focused on execution (such as the “bet the company” type of decision).

Strategy is often the “path charting” on the open seas. Yes, the vast majority of resources and challenges are actually doing the work to get from point A to point B, and because there will be so many unexpected challenges, the execution piece here must by definition be highly flexible and reactive. As

wrote recently in “The Case Against Prediction”, reliance on prediction to the detriment of rapid responsivity is typically the wrong move!But note that his point is NOT to completely avoid prediction, but instead to avoid both overinvestment and expectations that these predictions will yield highly accurate results. To return to our sailing analogy, the sailing itself is execution, and per Rohit’s recommendations, high responsivity is absolutely paramount -- storms, waves, mutinies, etc -- but before then, to where is the ship sailing? How can one be more certain that Path A will lead to land compared to Path B, especially when the wrong decision means the crew all die?

Knowns and Unknowns

Thus far we’ve discussed the generalized case for why strategy should neither be overlooked nor underinvested despite public narratives to the contrary. But as I’ve mentioned far too many times recently, context matters. In this case I’m referring to our knowledge context, which falls typically into three classes:

Known knowns

Known unknowns

Unknown unknowns

In a situation of mostly known knowns -- say, a product already has significant traction and the challenge is scaling, not discovery -- execution is relatively more important. But in that discovery phase, where known unknowns or unknown unknowns are far more prevalent and valuable (or costly) than known knowns, strategy is far more important. If we return to

’s GUTS framework I walked through in “Foundational Frameworks for Strategic Growth”, we would broadly say that the bottom two quadrants (Convergence) represent states for a company in which execution is relatively more important, whereas the top two quadrants (divergence) are the opposite.We might also equate this with other discussions of uncertainty and risk.

wrote eloquently about this in “Startups and Uncertainty”, where higher levels of uncertainty and/or risk place greater relative weighting on strategy to help navigate the unknown or unknowable waters.And from there, we might also assert that the Strategy<>Execution relationship varies heavily based on the stage of company. That is, the earlier the stage, the more heavily weighted toward strategy the company will be, and in later stage growth companies, the weighting is much heavier toward execution. But we should not place much emphasis on pure rules-based labels like this, as companies of all sizes bounce between different periods more highly concentrated on one or another.

Waves Visualization

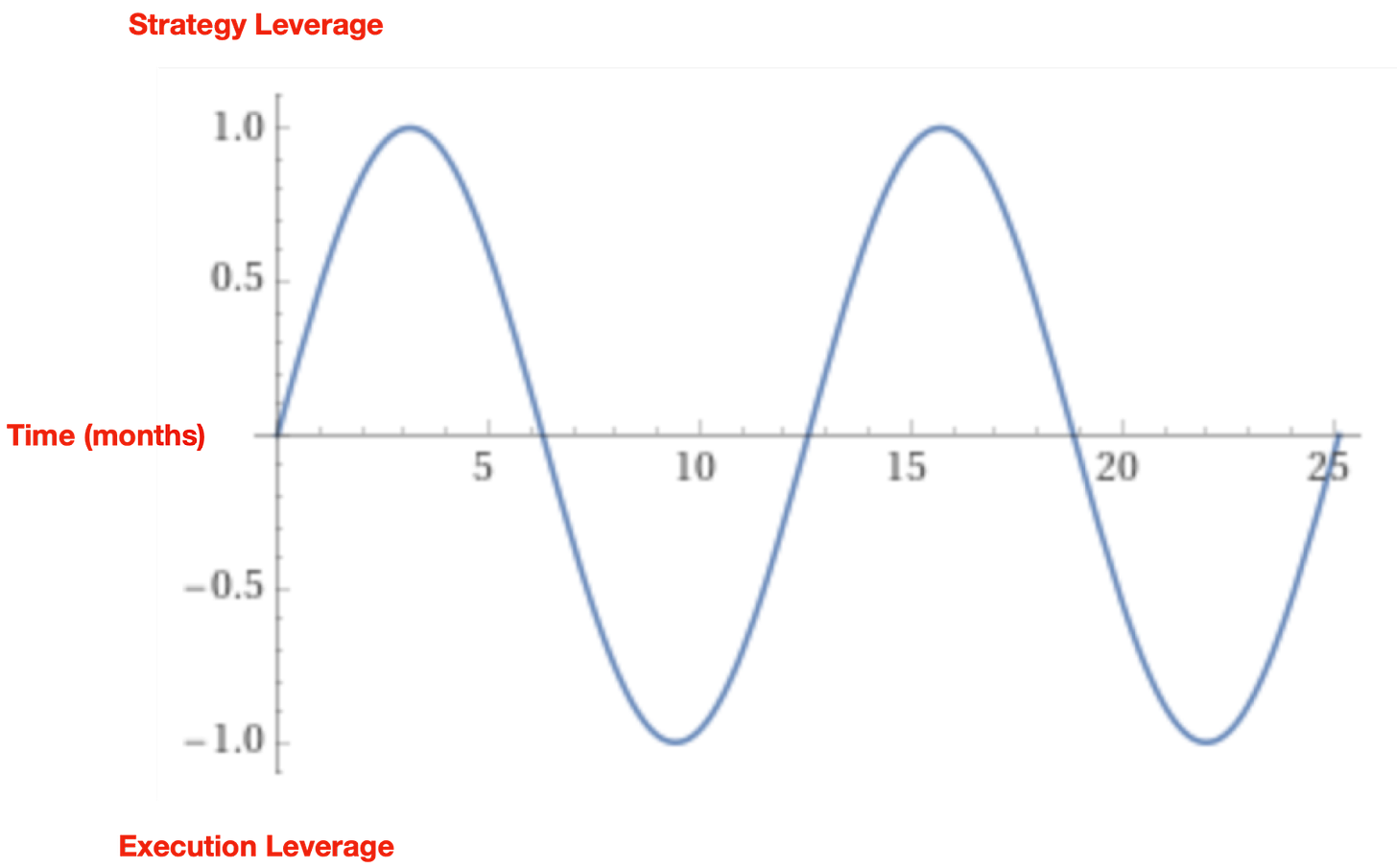

I can neither confirm nor deny that the continued use of ships on the high seas had an impact on my thinking regarding how to visualize the relationship between strategy and execution over time, but such it is that the visual framework that immediately came to mind was the lowly sinusoidal (wave) function, in which:

The x-axis represents time

The y-axis represents the relative leverage offered by strategic versus execution decisions at any given period of time, with 0 representing effectively a perfect balance between strategy and execution.

Companies, especially at different stages, will necessarily vacillate between these two, but their frequency and amplitude will look quite different. Generally (again, just generally - more on this shortly) the more mature the company, the lower the frequency. That is, the vacillation from execution leverage to strategic leverage may be measured in years or decades.

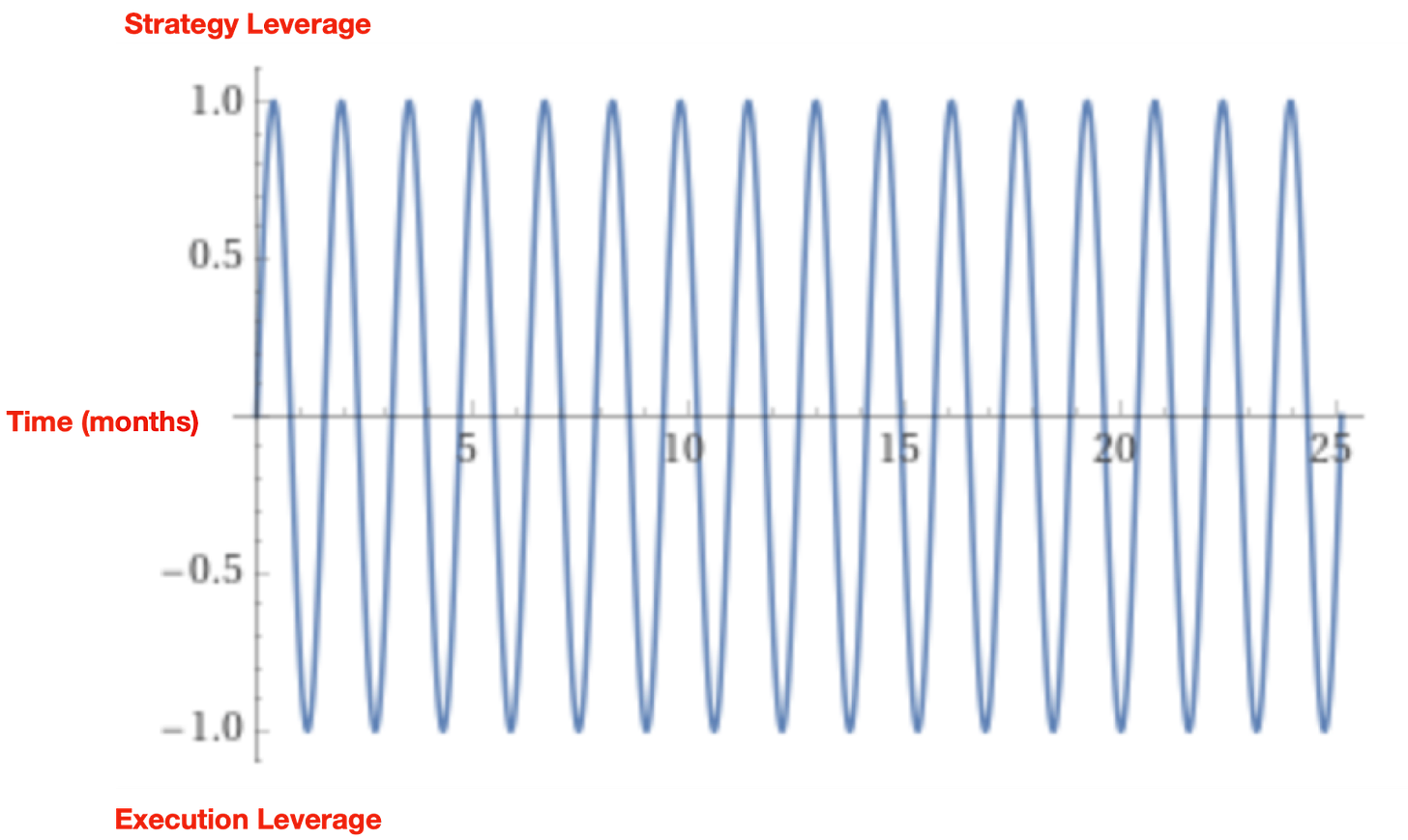

Early stage startups will generally exhibit much higher frequency, especially if leveraging a framework like Lean1, which structurally requires short bursts of testing (execution) and learning/synthesis (strategy) until product-market fit (PMF) emerges.

We should generally expect that the frequency of the strategy/execution function will then degrade post-PMF precisely because they can shift more energy (and gather more leverage) from execution than strategy; from scaling than discovery; from convergent versus divergent activities.

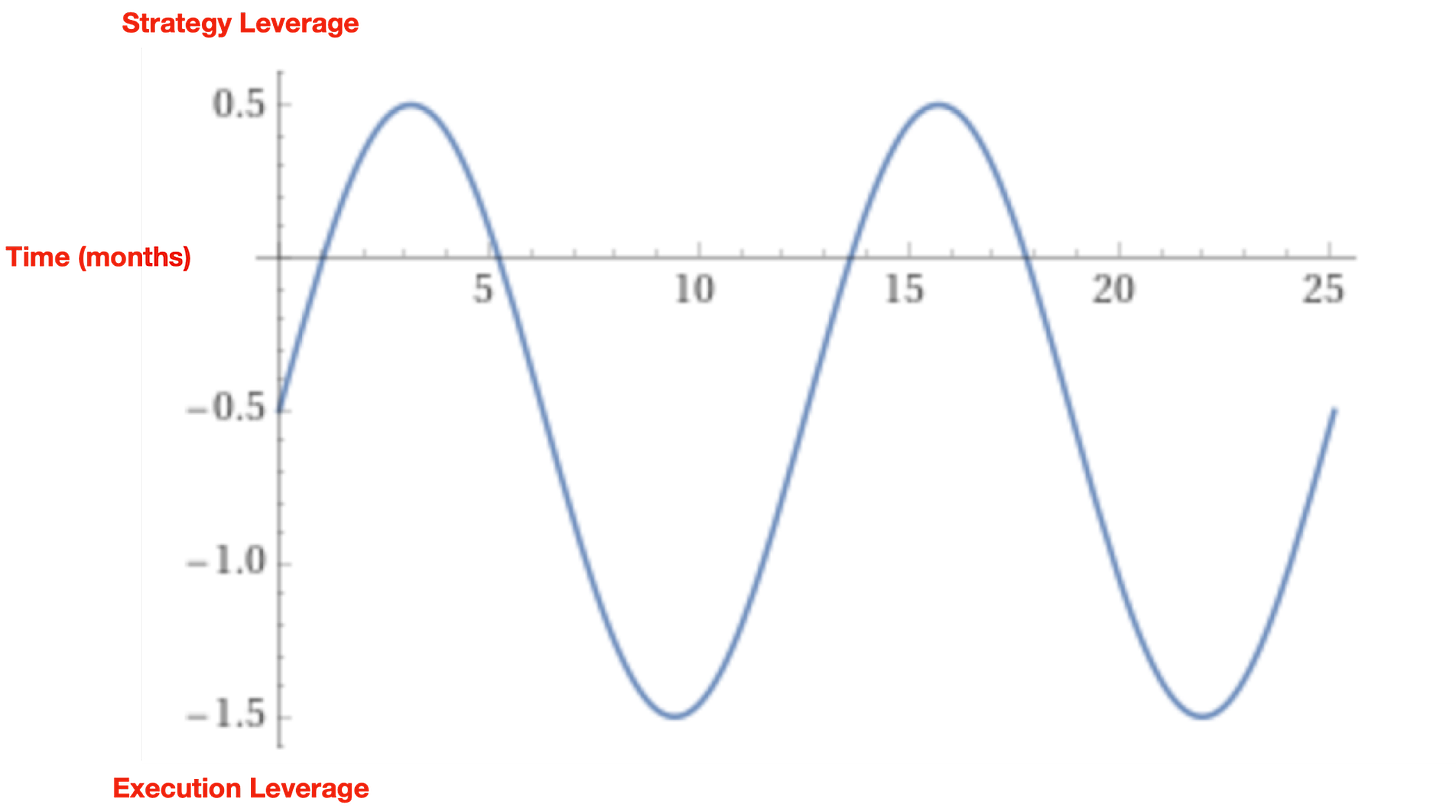

Thus far I’ve only discussed the frequency, but the amplitude also provides descriptive information as well. Remember that amplitude here represents the relative leverage that either strategy or execution provides. I’m not totally clear at this stage if this should always be built against each company’s baseline, or whether it should be done independent of the company. That is, are there company-independent benchmarks?

The company as its own baseline means that there is likely to be better precision and no need to worry about equivocating levels of leverage across all companies, with the downside that comparisons across companies become incredibly fraught and directional only.

Company-independent settings mean that max-min amplitude must be fully generalized, which is quite challenging, but with the benefit of being able to make more absolute comparisons between companies. That is, certain (types of) companies would simply never hit max-min because the decisions to be made are never as grave, or execution is never as hard. A typical B2B SaaS company would generally have a much smaller delta between its max-min than would, say, SpaceX.

A final vector here is the consistency of the shape. That is, how much do the signatures of amplitude and frequency shift over time? Higher consistency equates to greater stability, which means only that changes are not being made frequently. This is about what is, not what should be.

Companies in crisis would be expected to have much higher inconsistency as they thrash around. Put differently, looking at the entire curve should tell us whether the company is in Peacetime or Wartime (more on this shortly).

Company Level vs. Sub-Levels

In a single product, early-stage startup, there is necessarily only one wave, and it is the company wave. As the company grows, and as the org chart becomes increasingly complex, different subsets of employees will necessarily focus on different things, and within each of these different areas (not necessarily functional areas, though this is the easiest to consider) will start to emerge their own waves. These waves might look quite different between teams!

Thus as companies grow, the company-level wave might increasingly decouple from the underlying work, and the further the super-wave deviates from the supra-waves, the more internal thrashing and uncertainty we might expect to manifest.

Take for example an executive team operating a company-level wave that is consistent and predictable. We might assume that this company is healthy, operating in a post-PMF environment in which uncertainty is low and revenues are scaling. But peek under the hood and we note that many of the underlying wave functions are far more erratic -- these waves/teams are in fact in disequilibrium.

What does this tell us? Well, it is likely the case that executives either don’t understand or are explicitly ignoring the warning signs that the waters are choppy and require some deviation from the standard operating cadence. Having lived through this very scenario I can attest how destructive such deviation between waveforms can be!

Waves by Company Type

We should expect waveforms to differ not only by company age and urgency, but by type as well. An investment-focused HoldCo like Berkshire Hathaway will, in fact, see its waves stick primarily in the strategic realm, with only minor dips when it’s time to “execute”, which is seldom:

Buying a new company.

Major new investments.

Divestures

This wave function, therefore, illustrates that a company like this makes relatively few consequential decisions and instead must actually spend the bulk of its time in strategic work, with no obvious payoff.

In contrast, let’s take a company like Snowflake, famed for its execution prowess under Frank Slootman, which deals primarily with known knowns and thus spends the bulk of its time in long, execution-heavy periods.

In contrasting these two, we see a potential path to quantification here -- one of area under the curve. These areas under the curve describe the quantified proportion or a company’s resources that would be expected to be expended in the given areas over specific periods of time. We will need adjustments for differences in frequency, I think -- spending 6 contiguous months in execution mode should likely not garner the same metric as 6 months punctuated by many deviations into the strategic realm. But that’s a future consideration.

War Time vs. Peace Time

I’ve hinted at this characterization a couple times already, so let’s actually explore it explicitly. Ben Horowitz popularized the War Time vs Peace Time CEO dichotomy in “The Hard Thing About Hard Things”, and though I think the heuristic is quite useful, one major difficulty I’ve always had is that it is purely qualitative.

I think the Waves framework offers a complementary expansion to the initial framing:

In Peacetime, the company’s shape is consistent, predictable, and likely with both lower frequency and lower amplitude deltas.

In Wartime, we would expect the waves to be far less consistent, frequency to increase rapidly, amplitudes to spike, and (depending on the business) likely see the strategic amplitude remain elevated while sifting through the “what the fuck do we need to change” phase.

Per the above commentary, these shapes reflect reality, not how the CEO is actually behaving, and in fact a change in wave shape may actually portend that a shift in CEO behavior is necessary. That is, I suspect that waveform changes (first derivatives) may be leading indicators of behavioral changes, and not necessarily in the negative! For example, if a CEO has been correctly orienting the company to work through its choppy waves in wartime, the equilibration of waves could signal that peacetime is forthcoming; that all of the challenges the company has been fighting through have in fact yielded the intended effects.

Does this matter?

The humbling question one must inevitably ask when attempting to push the “frameworks literature” forward is whether any of this work actually matters. Well, at the very least I find it interesting! And as a consummate consumer of many, many frameworks, I’m not familiar with any specifically addressing the Execution vs. Strategy (false) dichotomy, and most frameworks don’t address the various contextual cues that heavily influence behavior.

Another piece I think will be helpful here is to bring a more “life cycle” approach to the discussion, which has historically been saddled with a static “do this, not this” framing rather than “do this IF/WHEN this [context]”. As I develop the framework further, I think it may also provide a different/complementary/structured way to quickly identify and contextualize how a given company looks relative to others, as a point of comparison with challenges they may be having. For example, the open question I posed regarding the potential quantitative nature of the approach must be directly addressed, as its efficacy would be far greater if it could in fact ingest live company data and spit out feedback.

Another close cousin of a question that arises from the quant/qual question is whether this framework is descriptive or predictive. If just descriptive, it helps explain what has been but provides no power in offering what could/should be. If predictive, the framework would offer future-state projections, such as - if consistency doesn’t improve, the company’s likelihood of survival will diminish by x%.

Where does it fit?

One major challenge with frameworks is that there are so damn many of them, but relatively little scholarship attempting to tie them into a more cohesive whole. It’s a project I’ve been meaning to take on and that now is a necessity -- to design a more coherent meta-framework with the likes of:

Michael Porter’s Five Forces, which was an early attempt at standardizing our views on the strengths/weaknesses of businesses.

Hamilton Hellmer’s Seven Powers, which best articulates the defensibility of a business.

Clayton Christensen’s Disruption Theory, which is a bit more focused on bottoms-up defeats of incumbents by startups.

Ben Thompson’s Aggregation Theory, which examines the power incurred by monopolizing demand offered to web 2.0 digital behemoths.

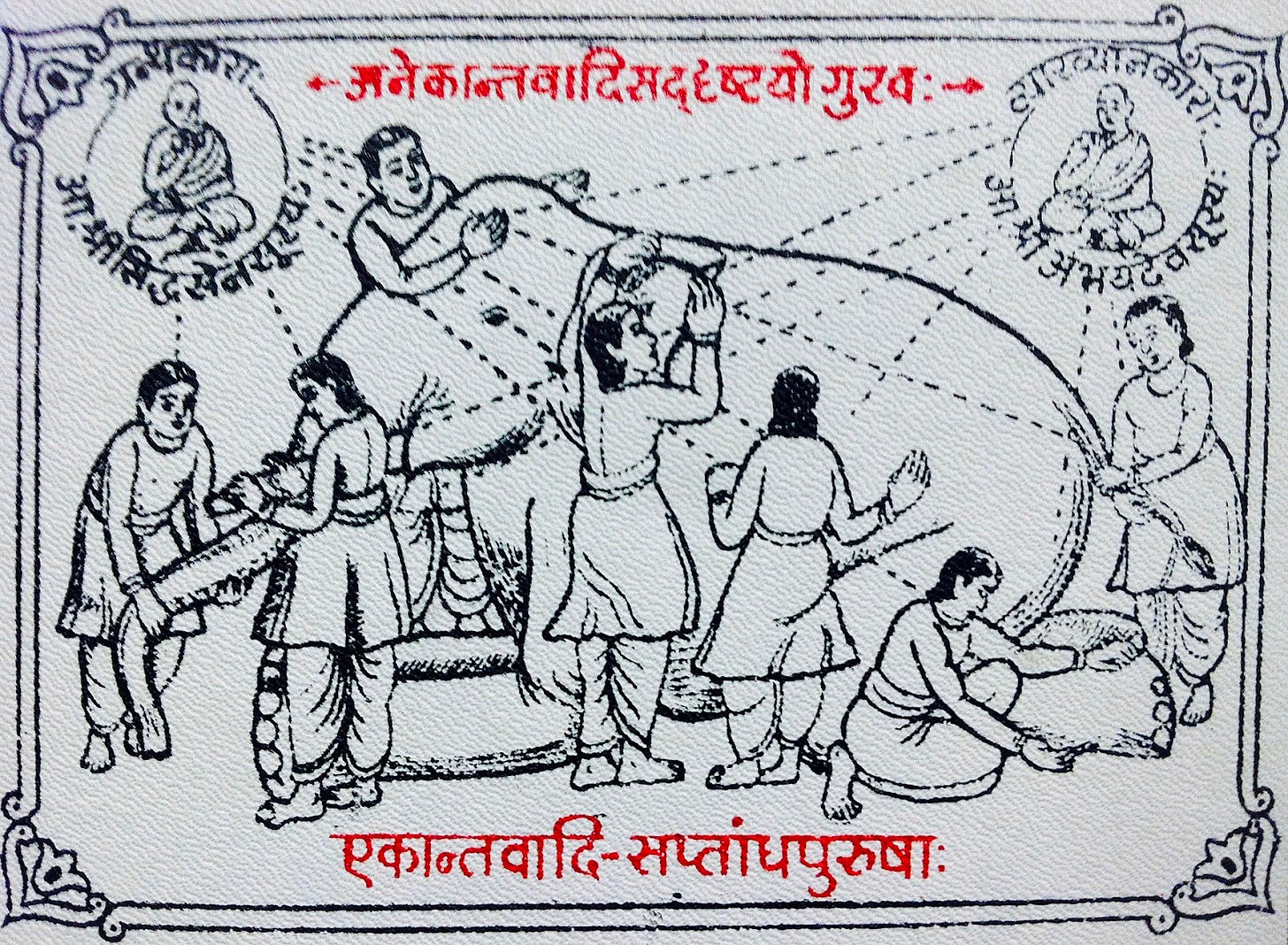

There are more than these, of course, but these are the most-cited in the tech sphere. Nonetheless, I’ve always found invocations of each individually -- or worse, “I prefer this to that” -- wholly unsatisfying, as none of these frameworks is intended to be comprehensive. No, they all describe specific facets of business strategy, and yet we still don’t have that cohesive meta-framework tying them all together. It reminds me a bit of the Blind Men and the Elephant parable:

More to come here, and as always, please add a comment below or contact me directly with any feedback you have!

Note that I’ve specifically conflated early stage with lean here. I believe it was Keith Rabbis who first used the term “fat startup” (or at least that’s when I first remember the phrase hitting my brain), and a fat startup is, as you would expect, very much non-lean. For example, hardware startups are often (but not always) non-iterable in the way that pure software companies are. Something - one thing - must be built at considerable cost. Say, a quantum computer. There will not be multiple versions of this, nor will there be short iterations on the fundamental design. In cases such as this, the early stage startup would be required to spend considerably more time in the strategic phase - call it pre-production, in film terms - precisely because there’s only one shot. In this scenario, the company’s wave would look quite distinct from a typical startup, with very low frequency, much more like the waves of a growth company.