Growing the Premier League Media Empire

An attempt to close the gap between the NFL's media juggernaut and the EPL's meager attempts to date.

Introduction

This is not a newsletter about sports, but as I noted in Football vs. Football, the objective, rule-based nature of sport makes for an interesting environment in which to explore the effects of systems, investments, and business structures on outcomes.

In that piece I briefly examined the topline revenues of the two largest “football” leagues – the NFL and EPL. Despite soccer being the world’s most popular sport, and the EPL it’s most popular league (far eclipsing the NFL), the EPL generates just 40% of the NFL’s revenues each year. So in the next couple pieces we’ll explore how to remedy the issue.

We’re ultimately attempting to define a growth path for the EPL that would enable it to overtake the NFL as the world’s preeminent “football” league, and that growth journey begins, as all sports revenues do, with media rights.

A quick reminder of the task at hand:

If we are to grow EPL larger than the NFL, we must somehow close an $8B delta in their media rights values 😬.

A Brief History of EPL Media Rights

The ties between the EPL and NFL are not merely academic. Rupert Murdoch’s Sky Television initially secured the media rights following the formation of the Premier League in 1992-3, and given Murdoch’s America-based Fox broadcasting arm had plenty of experience with NFL-style “razzmatazz”, he immediately set out to create a similar-ish style for English soccer media.

Needless to say not everyone enjoyed it! But Murdoch knew the “secret” behind monetizing sports – sports leagues are MEDIA businesses. Media rights represent a league’s strategic instrument for aggregating demand, smoothing out revenues, and providing far more revenue value to the collective than could have been achieved by teams individually.

Many fans, teams, and the government itself continue to struggle with this very basic truism today, but the work of Murdoch and a couple other partners have been transformative for the league:

“In England, the revenues of Premier League clubs jumped more than forty-fold in the thirty years from 1990 to 2019 [due to media rights]” - Soccernomics, p. 100

Though the intention was to roughly mimic the NFL’s media juggernaut, the realities of a less willing UK market have made this…challenging. Before we dive into the changes necessary to grow this business, we should first establish the foundation for how media rights actually derive their value.

What actually are media rights?

Media rights technically monetize via advertising, though to be clear, neither the NFL nor the EPL itself actually sells advertising. Instead they offer empty content containers into which the distributor (network or streamer) can insert the ads it has secured. Media rights revenues effectively represent the discounted value of maximal advertising revenue, the discount of which is created by offloading both distribution and ad sales to third parties.

A league could in theory say, “hey, I really don’t like this discount!” and forgo broadcast partners altogether. This is, effectively, what Disney decided prior to the launch of Disney+ when it saw how much Netflix was paying for Disney content (at a discount). Two CEO changes later, they’ve ultimately concluded what so many content owners conclude: building D2C is difficult, costs a lot, and it’s not actually clear whether it drives meaningful returns. Vertical integration of content production and distribution is not for the meager (or the cash poor).

In contrast, licensing is quite nice! It’s a relatively high margin business that obviates the need for the operationally intensive business of content distribution. Outside of the NFL dabbling with its (tiny) NFL Network, both the NFL and EPL (correctly) prefer to preserve their capital for production and leave distribution to others.

Like all advertising businesses, value is derived from three primary components:

Reach: how many unique people can and do watch each game each week?

Ad Load: how many ads can be shown to a given viewer within each game?

Price: how much will each ad cost?

That’s it - every ad business ultimately reduces to some combination of

Reach x Ad Load x Price

This is obviously (and purposefully) reductive! But it’s important nonetheless to anchor to this simple equation as we talk about media rights values, because this is ultimately what these values represent. And not all ad offerings are created equal – each sport offers broadcasters a fundamentally different opportunity, both operationally and financially.

Football is a discontinuous sport. Individual plays are run, plays stop, and then start again. Add to this the three timeouts per team per half, timeouts for injuries (which are prevalent), and “TV timeouts”, and it’s clear that football is a perfect medium for advertising because of the built-in ad breaks.

Soccer is a flow sport. It is played continuously for 45+ minutes in two halves. “Set pieces” (corner kicks or direct/indirect free kicks) are the only loose equivalent, but these again occur in the normal flow of play. There is no full “ad break” (that is, a full shift for the television viewer from the game to an advertisement) until half-time.

We’ll dive into this further as we discuss the actual value of media rights, but football and soccer each have unique (dis)advantages that enable differential returns for broadcasters:

Football is a perfectly constructed medium for standard mid-roll video advertising, with high ad load, high viewership per game (but limited growth prospects), and (unfortunately for the broadcaster) high pricing power.

Soccer is, as constructed, much more poorly suited as an advertising medium, with low (current) ad load and only modest per game viewership, but with tremendous opportunity to grow viewership both domestically and internationally.

In short - football is a sport constructed and optimal for television viewing. Soccer is a sport constructed and optimal for in-person viewing. This contrast has a fundamental impact on how the executives of each league think about their product, how fans interact with their product, and ultimately how monetizable each product is.

So how might the EPL catch up? I have a few ideas 😀.

Growing Media Rights Value

The beauty and challenge of this endeavor is that there is so much green-field opportunity available. This is a bit of a back-handed compliment as it necessarily means that the EPL has thus far done a really poor job monetizing its product.

Remove the Rush Hour Laws

Let me pose a question – can residents of the US or the UK watch more Premier League matches today? The fact that I’m asking this of course signals that the obvious, logical answer is incorrect. And so it is that the US broadcasts all 380 EPL matches each season, and just 200(!) are actually broadcast in the UK each season. Let me repeat that:

ONLY 50% OF ENGLISH PREMIER LEAGUE MATCHES ARE ACTUALLY TELEVISED IN THE UK

The reason is simple: Rush Hour Laws.

US readers will likely be familiar with “local blackout” rules, which would prevent the televising of a match in the local market if tickets to that match did not reach a specific threshold. The logic here has always been dubious – that TV availability disincentivizes game attendance – and though Richard Nixon compelled Congress to outlaw NFL blackouts back in 1970, the league simply hasn’t required it in many years with stadium capacities well over 100%1.

The UK equivalent to the blackout, Rush Hour Laws:

“originated in the 1960s; Burnley F.C. chairman Bob Lord was opposed to television broadcasts of football matches — going as far as banning the BBC from televising Match of the Day from Turf Moor for a time.”

This is not a local blackout but a NATIONAL one. Between 245pm and 515pm on Saturdays, soccer can not be broadcast on live television, despite there being no definitive study demonstrating ANY link between rising TV viewership and falling game visitation2.

As has typically been the case historically when media distribution is artificially restricted, consumers always find a way; and by that I mean illegally stream. These are not small numbers – a cool 7M viewers regularly stream EPL matches, and they do so because the games aren’t available to view legally.

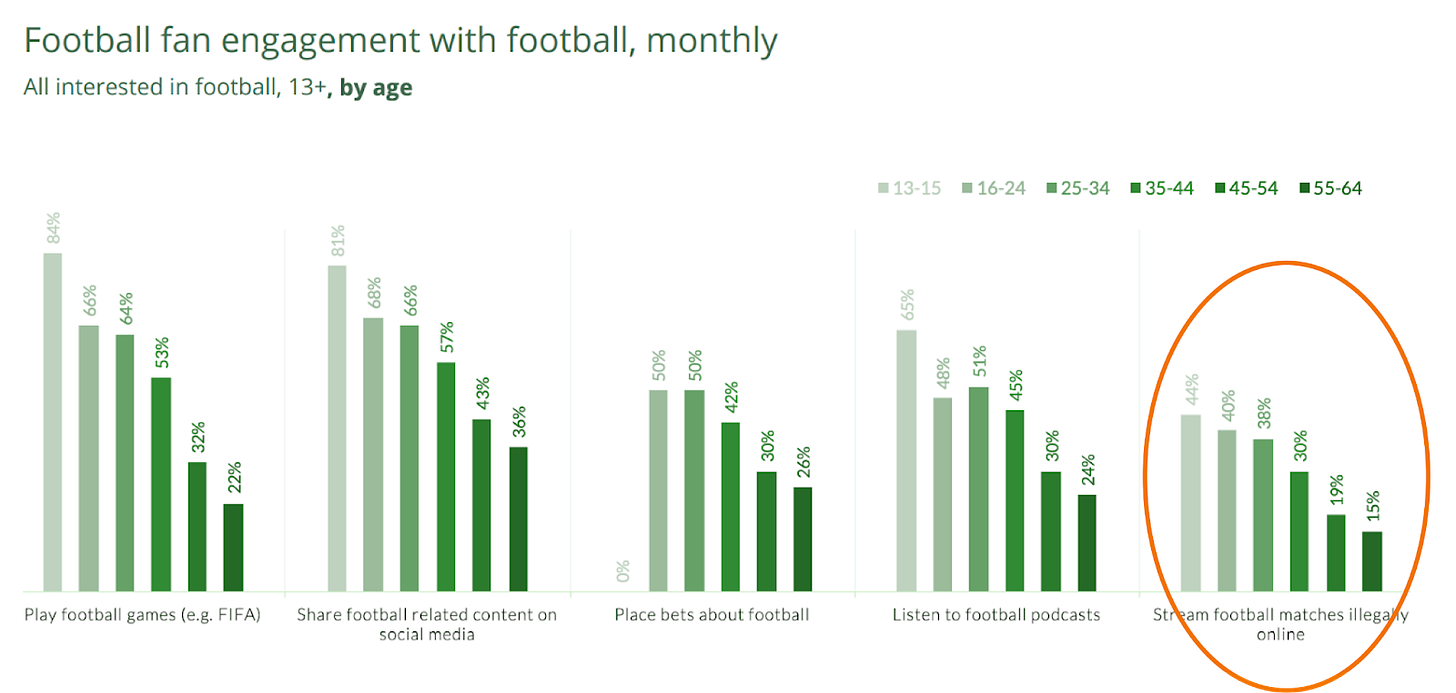

Let me restate that illegal streams represent 3.5x the watermark of success for broadcast viewership (i.e., 2M viewers). Nearly as many UK adults in total (30% vs 40%) illegally streamed EPL matches than watch the broadcasts, and we reach essentially parity for those under 25:

As a baseline, then, we know the following to be true:

Only half of all matches are today televised and monetized.

Illegal streaming viewership is consistently higher than broadcast viewership and cites “availability” as its number one reason.

There’s a massive, domestic audience for this content that is prevented from accessing it because of completely antiquated and self-serving 60-year-old laws that in reality fundamentally harm both the EPL and English football overall.

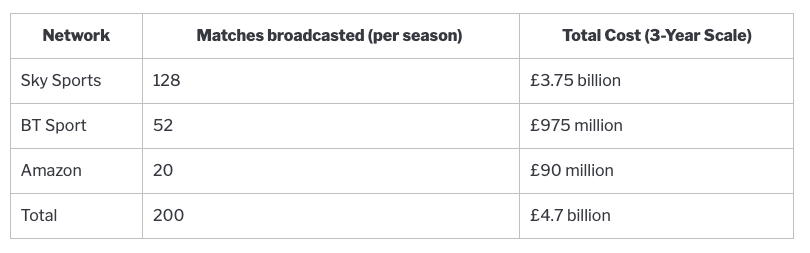

Let’s take the latest domestic package:

If we bring the total matches to the 380 total, and conservatively apply a 20% discount on the value of the remaining games, we create an additional $1.43B per year in domestic media rights alone.

But if we are to repeal these laws, we still have another problem to be alleviated in parallel…

Rebuild the Calendar between EPL & EFL

I left out one reason for the persistence of these laws:

“This policy is ostensibly intended to encourage fans to attend football matches in-person, especially in lower divisions that compete with top-flight matches on television.”

This may be confusing to a typical American given our lack of substantial minor leagues, but the basic setup is this:

There are five divisions of professional soccer in England, the Premier League being the top league, and the English Football League (EFL) representing leagues 2-4.

As the top league, it is by far the most lucrative, and as part of the Football Association (FA, the UK’s governing body for soccer) it has an obligation to share some of its revenues with the other leagues.

The most recent agreement has the EPL sharing $1.9B over three years.

Given this context, let’s revisit the quote – Rush Hour laws are specifically meant to encourage foot traffic to games, and especially those of the Championship (the second league, just below the Premier League). The Championship specifically gets subsidized heavily by the EPL’s revenues, and they’ve decided to fundamentally impair the very revenue-generating mechanism necessary for revenue sharing?!?

Look, I realize I’m an American casting stones at this glass house, but my god the inanity.

Let’s make this really simple – if you want to incentivize attendance at lower-division games (which is a good thing!), how about we instead, I dunno, build their respective calendars to have as little overlap as possible?! This creates two quite obvious paths for better EFL monetization:

Indirectly: higher EPL revenues leads to greater revenue sharing

Directly: Avoiding “EPL game days” should enable greater opportunities for owning media for their own days.

As Tifo lays out, UK football makes no effort to stagger matches, so there is substantial overlap. In contrast, the top two Bundesliga divisions are completely non-overlapping, and all games from both leagues are televised every weekend with no blackouts.

This piece is not about the incredibly challenging structure of English football overall – I’ll reserve some spicy takes for next week – but this structural change very much aids the EPL’s monetization efforts itself by fully removing any remaining rationale for the perpetuation of Rush Hour Laws, while also providing a clearer path for (dare I say it) NFL-like branding of different days of the week built as media packages?

By cleaning up this scheduling and improving day of week branding, let’s say that we can improve viewership enough for an additional $250M in media value.

Increase Ad Load

I will caveat immediately that as a viewer, I love the clean, simple interface of a soccer match, almost completely devoid of advertising outside of the occasional “banner ads” shown briefly at the top of the picture. That said, the league could definitely be more assertive with its distribution partners in experimenting with more expansive in-game advertising.

As I mentioned above, soccer is a game of flow, and so traditional “mid-roll advertising” that takes over the full screen is literally impossible except at halftime. That said, there should be an opportunity to incorporate the “split screen” advertising that the NFL, NBA, and others have incorporated into their media mix the last several years.

The ball is only in play for about 55.7% of EPL matches today:

The remaining 45% is composed of goal celebrations, throw-ins, injuries, setups for set pieces, and various time wasting efforts. These are unplanned and unpredictable breaks in play, but they should offer distributors the time to cut away to a split screen for interstitial advertising, whether video or static. The split screen keeps the action fixed on the screen but enables the distributor to capitalize on the inaction with an increase to ad load.

I am not at all certain how much value this would create; I am 100% certain that this will piss people off. But in this exercise of maximizing media rights, it is a no-brainer that such experiments should at least be conducted.

For argument's sake, let’s say that substantial increases to ad load may increase total global ad revenues by…$500M-$1.5B, depending on the level of aggression in the implementation.

Increase the Competitive Equilibrium

I already wrote about this at length in Trophies for Sale, but put simply – greater levels of competition increase the potential drama of a sports product, greater levels of drama increase viewership, and higher viewership quite obviously leads to greater value of media rights.

Part of this push for equilibrium falls to revenue sharing practices. Value accrues to individual clubs in a fundamentally different capacity:

NFL club values degrade linearly, and thus the league’s revenues are quite equitable.

EPL club values are highly concentrated in just six clubs (the “Big 6”), and thus the matches for these clubs are highly prioritized over all others.

This revenue and valuation differentiation between the leagues also extends to its sharing of media rights revenues:

NFL media revenues are split 100% equivalently. Yes, that means the Cowboys are paid out the same amount as the Browns, and yes, Jerry Jones has never been a fan of this.

Only 50% of EPL media revenues are shared equally, with the remaining 50% tied (mostly) to club performance. As I’ve detailed, this means that the Big 6 effectively always make significantly more than their non-Big 6 peers.

For argument’s sake, let’s say that increasing the level of competition increases viewership to the tune of, I dunno, $250M per year globally3.

Expansion of international media licensing

Thus far we’ve only discussed the domestic media rights; but as I alluded to before, last season represented the first in the EPL’s history in which international rights represented greater value than domestic. This is both a watershed moment and also reveals how much opportunity still exists here:

The current UK viewership is about 27M people, which I’ll translate as about 12M total homes.

The league reaches an additional 631M homes outside of the UK

This roughly equates to a monetization rate of about $163 per home in the UK and…$3 per home outside the UK. Given that this monetization rate is preposterously low, I feel pretty confident assuming that “homes reached” is a massively overstated proxy for actual viewership. Even if we cut this down by two-thirds, though, we still hit an ARPU of just $10. We can thus see substantial opportunity to further monetize international audiences.

The league has already started to improve this in the US, where their latest deal is $2.7B over 6 years, or $450M/year. Given the new set of deals signed for the 2022-25 period totaling $2B/year, this means international ex-US equates to $1.55B/year.

So we’ve reached this point of no return for the EPL, after which domestic rights should (likely) never reach equivalence with the international rights again. And though international monetization rates as a whole will never reach domestic levels (given the influence of many lower-income markets), what might the league take on to nonetheless increase these rates?

US Focus

The league has done a solid job in securing half a billion dollar annual media rights, and several top teams regularly tour the US with a handful of exhibition matches. But given the US is already the league’s largest international market, and given the growing base of true soccer (and EPL) fanatics (myself included), the EPL should set its sights on the US becoming its first billion dollar media market outside of the UK. Some basic thoughts:

For at least the next 5 years, make mandatory US exhibition tours for its constituent teams. Rotate these between the squads, making sure that 1-2 of the Big 6 participate each year, but use these tours to further build American interest in English football, especially leading into the 2026 World Cup.

Speaking of which, the US has a World Cup shortly4! FIFA has tight regulations around its own monetization, as well as a contentious relationship with both UEFA and individual clubs. But the EPL should do whatever it can to work its way into the massive festivities in just 3 years.

Consider a more formal partnership, whether commercial or talent, with the MLS5. Many purists will scoff that MLS is a second- or third-rate league, and they’re not entirely wrong. But MLS is also the top league in the world’s largest market, and one that the (arguable) GOAT just joined. Messi never played in England, but his celebrity would certainly be useful in further bolstering the world’s best league.

Take a page from the NFL expansion playbook and move beyond exhibitions to playing actual league matches in the US. Given the overlap with the NFL season, and even college football season, it would be hugely important to schedule these appropriately – Saturday would be ideal, though if the college football conflict is too great, perhaps a Friday. Season ticket holders would quite rightly be upset! But for the vibe it may be valuable for the league+teams to subsidize travel for a contingent of their followers to travel with the team.

Capitalize on the growing number of US players in the EPL by developing content specifically about them. The US finally has a growing number of top players, and we very obviously love our high-quality sports content. This seems like a no-brainer opportunity (and more about content in a bit).

International Growth

International can be quite challenging specifically because advertising monetization rates are so low throughout much of the world. The EPL can better influence viewership, and by expanding the number of distribution partners it will certainly continue growing viewership capacity. Much of the US playbook might also apply here, though with fewer country-level returns:

Expansion of the exhibition season.

Playing actual league matches abroad.

Better alignment with each World Cup.

Additional content focused on local players.

What are these changes worth? I already argued that the US should be a billion dollar market, and if we’re doubling the value there, let’s say that the rest of international can grow another 70%. This gets us to an additional $1.6B/year.

Broader media investment

Thus far we’ve only really focused on the media product as it is, which means an exclusive focus on live broadcasts of the matches themselves. But what has turned the NFL into a true media juggernaut is its consistently evolving cadre of monetizable media properties that have enabled it to truly monetize year-round.

Amazon’s “All or Nothing” series has already done a solid job exposing US audiences to clubs like Manchester City and Arsenal, and it would behoove the EPL to ensure not only that this continues but also that it expands, especially to focusing on smaller clubs with great stories. The “Welcome to Wrexham” series has been an incredible success, and not at all replicable given the celebrity involvement, but the fact remains that “smaller” stories can and will find audiences.

I’ll touch on this more in next week’s piece, but the league must broaden its appeal beyond the Big 6, and a more expansive view behind the scenes of incredible clubs that just happened to be in small towns would go a long way to at least exposing international (especially US) audiences not just to these clubs but to their towns. Here I’m thinking about Brighton, Fulham, Bournemouth, and the like.

It should also expand its own in-house development capabilities similar to NFL Films to ensure that the league itself continues to churn out high quality content, independent of its teams. Manchester United, for example, has a large in-house production team to provide content to its OTT service Manchester United TV (MUTV). The EPL should not depend on its teams to provide high quality content to its global fanbase!

This is all table stakes. OF COURSE the league should invest more heavily in content surrounding its season. But the NFL has been masterful for building new media products every decade, which has enabled it to not only expand beyond Sundays to Mondays and now Thursdays, but also to become a truly year-round league. We take it for granted now that they’re major media properties (and money makers), but twenty years ago major media properties built around the following would seem absurd:

The draft

The combine

Free agency itself

The EPL cannot directly replicate this, of course; there is neither a draft nor a combine within the open structure of international soccer. But this is a mindset that must be fostered – that fans of the league want as much content as they can get, in-season and out, and as such it is incumbent upon the league to design new media properties to capitalize on this demand. A few basic thoughts here:

Transfer Windows

There is tremendous intrigue and drama built into the Summer and especially Winter transfer windows. Yes, these windows pertain to all European leagues, but still – there’s an incredible energy in seeing great (and not so great) players shifting allegiances with increasingly mind-numbing transfer fees. The Winter window itself is so interesting both because of its shorter length and its mid-season location. It literally influences the end of season results, yet the coverage feels much more like news than entertainment.

Build a Relegation Tournament

European club soccer is quite alien from an American sports perspective in that it does not actually utilize a “tournament” (i.e., the playoffs) to determine its champion every year. I discussed at length how this negatively affects competitive balance and effectively guarantees the Big 6 will win every year, but the impact here is also monetary.

Sports tournaments are a big business! The Super Bowl alone generates around $300M for the NFL, and the two biggest events in international soccer are both tournaments (UEFA’s Champions League and FIFA’s World Cup). Let’s for arguments sake say that the EPL would fold before implementing its own playoffs to crown its champion (though I think it should at least be considered!).

There’s another opportunity for building a tournament from scratch that would both increase end of season drama and introduce a new monetizable element to the mix – a relegation tournament. Today relegation is automatic – the bottom three clubs from the Premier League drop down to The Championship, and the top 3 then ascend. An automatic inter-league Do Si Do. Most often these results are known before the last day of the season, further limiting the drama.

Instead, let’s imagine a scenario in which the same six teams are placed into a tournament to determine their fate. It’s possible that in a given season no EPL team is relegated! More likely is that some teams in the relegation zone would remain up, and some in the lower tier would be promoted. Either way, this would make for incredibly compelling television (and atmosphere) over a couple week’s time.

There’s some precedent to this already – Wrexham famously lost in a small playoff two seasons ago, the Scottish League runs a similar (though poorly structured) playoff, and Bundesliga relegation involves playoff matches. Even the NBA recently instituted a small “play-in tournament”, which boosted drama/excitement and appears likely to remain a piece of the permanent mix.

The point here is not to be comprehensive in dreaming up new media properties – just that new media properties must be core to the DNA of the EPL’s media rights ambitions. For argument’s sake, let’s say that these new additions add another $500M globally to the mix.

In Closing

I’ve proposed here a relatively straightforward path for the Premier League to significantly increase the value of its media rights as we attempt to close the gap with the NFL:

$1.43B from removal of the Rush hour laws

$250M from cleaning up the schedule and improving day of week branding

$500M-$1.5B from increases in ad load

$250M from increasing league competitiveness

$1.6B from expansion of international rights

$500M from new media creations

This completely unscientific guesstimating would yield an additional $4.5-5.5B in annualized media rights value for the EPL. This doesn’t fully close the gap – the NFL still leads with $11B versus $7.5-8.5B – but it will have significantly narrowed. And to actually reach the point of equivalence, I think we’ll need to make some more extreme changes to the structure of the league itself. I’ll save that for next week.

I say over 100% to account for the long backlogs of prospective season ticket owners that many teams enjoy.

I would probably make the opposite claim - that exposing the matches to more total people increases the total interested base of supporters who will at least occasionally want to shell out greater experience for the in-person experience. Remember that just 24% of adults in the country that birthed the beautiful game watch matches each season.

This is ESPECIALLY true for non-EPL divisions who get limited exposure - putting the second division on TV very likely will INCREASE match day revenues for those clubs simply because a greater casual audience has been exposed.

Szymanski & Kesanne argue that increasing revenue sharing may actually increase inequality between teams and decrease competitive balance. The more unequal the teams already are, the greater benefit the worse teams receive compared to the reduction of the best teams. Effectively the worst teams are incentivized to invest less in all phases, which maintains and/or exacerbates their poorer position in the league. Though I’m sure the Nash equilibrium-focused math is correct, this feels like a place where the assumptions of the theoretical model obscure the reality of such moves.

Yes, yes, I know - it's technically shared with Mexico and Canada.

My club, Arsenal, played an exhibition match with the MLS All-Stars this Summer. This is a good start even if the Gunners summarily dispatched MLS' best.

Curious to get your take on the Super League, since that model resembled the NFL model a lot more in terms of finances but was deemed as anti-competition.