Cementing Cinematic Synergies

The final part of the series, with a ridiculous title befitting the current relationship between Exhibitors and Distributors.

The Shortcut:

As must-see content expands further into the living room, theaters must adapt programming to meet shifting demands and stay relevant. That is - movie theaters must evolve beyond movies. And to do that, the tenuous 100-year partnerships between exhibitors and distributors must fundamentally change.

Read Time: 18 minutes

Parts in the Series

Introduction

“Am I worried? Of course I’m worried. The cultural space in which the movies I care most about have flourished seems to be shrinking. The audience necessary to sustain original and ambitious work is narcotized by algorithms or distracted by doomscrolling. The state of the movies is very bad.” - AO Scott

This series has thus far attempted to revitalize the theatrical film business in a number of ways:

In Part 1, we took a look at the current financial positioning of the Big 3 Exhibitors and concluded that they must significantly cut down the current theater supply to both match current levels of moviegoer demand and fundamentally improve their balance sheets.

In Part 2, we dove into the broad and systematic price discrimination tactics across both one-off and recurring transactions that Exhibitors can/should use to significantly improve customer ARPU, improving their profits and cash flows, putting them into a far better position to take on the larger, longer-term product changes.

In Part 3, we focused on the customer experience itself and generally the need for a resetting acceptable standards of both physical and digital interactions with moviegoers.

In this concluding piece in the series, we’ll attempt to reset the relationship between the protagonists in our story: Exhibitors and Distributors.

A Brief History of of Distribution and Exhibition

I’ve spent far too many words at this point discussing Exhibitors and Distributors, back and forth and back and forth, but I never actually touched on why Exhibition and Distribution are separate disciplines to begin with.

Netflix, the exemplar of the Streaming Age, has no issue operating in both capacities (with “exhibition” here being loosely equated with streaming). More to the point, Netflix was, like theaters, wholly reliant on third-parties for content for the first decade of its existence, an untenable scenario that ultimately kicked off the largest content investment in the history of the industry.

Why couldn’t AMC or CineWorld or Cinemark simply run the same playbook? Why haven’t they just invested in their own content? Imploding balance sheets aside, the reality is that for 70+ years such a vertical alignment between Exhibition and Distribution was illegal.

In 1948, the Supreme Court laid out in United States vs. Paramount the federal breakup of the “old studio system”, in which the major film studios (almost all of whom retain that status today) were forced to divest all holdings in Exhibitors:

“In Paramount, the Justice Department sought to break up a cartel of eight distributors that controlled the production, distribution, and exhibition of movies in the United States. These distributors engaged in price fixing of admission prices, allocated geographic areas of distribution, and engaged in a few other collusive practices.

In an attempt to open the industry to competition, the Paramount court ordered the distributors to divorce their exhibition businesses and prohibited various forms of vertical arrangements between distributors and exhibitors. The three key prohibitions were: (i) a prohibition against expansion into the exhibition segment, (ii) a prohibition against intervention in box-office pricing, and (iii) a prohibition against any movie licensing negotiation, which is not in the form of theater-by-theater and movie-by-movie.”

Taken together, the 1948 ruling ultimately forced Exhibition and Distribution to separate into functionally distinct disciplines and companies. From this point of separation, however, equality was never a possibility. Cartels don’t like to share, and they certainly don’t like being told what to do.

The Exhibitor-Distributor Relationship

Though never equals, Exhibitors certainly had more leverage following the Paramount Decree than they do today. Only 1% of households at this time owned televisions, so theaters represented the only mode of distribution for the Distributors’ product.

Just seven years later this “distribution monopoly” had collapsed, as nearly 75% of households owned TVs and the “bank run” was on. We don’t have to rehash the rapid secular decline of theatergoing, but with this decline evaporated any (scant) leverage the Exhibitors had over the content cartel.

No, Distributors today hold (almost) all of the leverage from a cascade of compounding advantages:

Theatrical revenues are highly concentrated, with 88% coming from the seven largest studios.

Distributors receive the majority of theatrical revenues in the first week of a film’s launch (from which it tapers toward Exhibitors).

The Distributor rev share is even higher for Event films, which have increased their total proportion of the Box Office over the last decade (call this the “Marvel Effect”):

The exclusive theatrical window has compressed significantly and now averages 4-6 weeks for major releases and shorter (often one week or day-and-date) for smaller films, further advantaging revenue shares toward Distributors.

Box Office Revenues as a share of total revenues for the Studios have fallen precipitously, so their dependence on the window has never been lower.

Each of these facets individually favors the Distributor and in totality has removed any modicum of leverage that Exhibitors held, save for one: a theatrical release continues to be the best vehicle by far for mass marketing of blockbuster films, and yet it has only enabled the Big 3 to eke out a rev share of ~ 50%.

Each side of the “partnership” will of course argue opposite sides of the fairness of this arrangement:

Distributors cover all content production and most marketing costs, taking on significantly greater upfront risk and therefore deserve a higher share and faster payback.

Exhibitors counter that Distributors mitigate most of this risk with their windowing and multi-stage monetization models, and that every change made over the last several decades has favored the Distributor.

Each side is correct, to a degree, but relative correctness is not a leverage creator. The reality is that theatrical exhibition is a nice to have for Distributors. In contrast, Exhibitors cannot exist without Distributors; theaters need content, and because of the Paramount Decree, Exhibitors were barred from owning their content supply chain for 70 years.

That Distributors hold the vast majority of leverage here is inarguable, but Distributors are also facing significant profitability headwinds from their heavy (and often foolish) investments in studio-specific streaming platforms, and as the pandemic showed, movie consumption is substantially diminished on streaming without a theatrical release. As such, there’s a sliver of an opening here for Exhibitors to exploit.

If both sides can agree that the theatrical business is both important and that it can actually grow for at least the next 10-20 years, they should similarly agree that the goal of the partnership is to maximize the TOTAL value and downstream impact of the theatrical business. If that is indeed the case, there are three significant sets of changes that must happen:

The definition of “must see” content shown in theaters must adapt to modern demand.

The revenue sharing agreements that bind the parties must evolve to better capture theatrical<>streaming realities.

With the fall of the Paramount Decree, both parties should at least explore vertical integration for the first time in eighty years.

Redefining Theatrical Content

Content Defined by the Distribution Medium

Prior to the internet/digital age, filmed content was designed explicitly for its specific medium of distribution. Movies were shot on film stock (thus “films”) and projected with complex, expensive mechanical instruments, tended to and tuned by craftsmen.

Shooting on film was (relatively) expensive, from the cameras themselves to the film stock to the reproduction of final film spools delivered to each theater, but film also represented the highest quality image.

Thus movies (films) represented not only the highest cost but the highest quality offerings of “filmed entertainment”, exclusively available in theaters precisely because these were the only locations that could afford the technology required to actually watch the movies.

What we confusingly call “television” - that is, content made for television - was, from the start, very much not like movies:

Each movie was singular and short, whereas television was episodic and long-form.

Movies were produced (relatively) slowly, whereas television had to be churned out quickly to meet the volume demands.

Movies used top-end equipment, whereas television had no problem adopting tape or any other form of cheaper technology.

Movies were (generally) higher quality, sometimes “art”, whereas television just had to fill enough entertainment hours.

Movies attracted top talent, whereas television was exclusively a medium for non-movie talent.

The point here is that the distribution technologies of theatrical exhibition versus television broadcasting represented functionally distinct forms of entertainment, with movies very clearly representing the more expensive, higher quality, “must see” content.

The “movie” piece of “movie theater” is, then, a cultural artifact of this former reality. Theaters had exclusive access to the best quality content precisely because they could afford the technology necessary to show (exhibit) this content for consumers, then amortize these costs over thousands of screenings.

The Pilot that Changed an Industry

Arguably it was Lost, and more specifically its pilot, that ushered in a new age of “cinematic long-form” that catalyzed the collapse of the cost/quality divide between movies and television. The Lost pilot was, at the time, the most expensive episode of television ever produced, costing somewhere between $10M and $14M.

This feels quaint today, when Amazon just spent $465M for just eight episodes for its premier season of the Lord of the Rings series, but at the time viewers lost their minds. I lost my mind! We’d simply never seen a television show that looked as good as a movie.

This massive investment, again both financially and creatively, ultimately ushered in the “Golden Age of Television”, with shows like Game of Thrones and, more recently, The Last of Us (almost always HBO) truly becoming “must see events” that not only (easily) surpassed viewership of major films but elevated television to the top of the cultural zeitgeist.

What constitutes “must see” content fundamentally shifted after that Lost pilot, and movies will never again perch upon Olympus as they once did, yet “movie theaters” are still wedded to the old model of movie preeminence.

The pessimistic view of this evolution is that, well, movie theaters are DOA if movies are permanently diminished in importance. The optimistic view (my view) is that Exhibitors are uniquely positioned to provide a differentiated product experience due to three major developments:

Digital distribution and storage of all content is cheap and easy.

Equipment costs for theatrical quality video have diminished so significantly that effectively all filmed content now qualifies.

The content explosion means that Exhibitors have greater optionality than they’ve ever had.

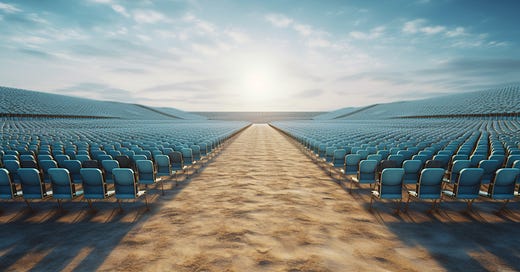

The first two points should be relatively uncontroversial, but it’s the final point that represents a paradigm shift for Exhibitors. Whereas movies historically represented the only “must see” content and therefore represented the only content format Exhibitors would show (or patrons would show up to watch), theaters should instead think of themselves as the purveyors of “must see” content in all forms.

This wider aperture thus allows for the inclusion of various high demand, scarce, event-driven forms of content - sports, music, and, yes, the biggest television content as well.

Theatrical Content is Must See, Not (Only) Movies

What I’m suggesting here is that Exhibitors must evolve their “movie theaters” away from movie exclusivity and toward a model where ALL nationally relevant, must-see content is available to watch communally on the largest screen with the best sound:

Super Bowl, NBA Finals, and World Cups

Game of Thrones season premieres/finales

Coachella headliners

Every major form of content, whether filmed or live, should be part of the Exhibitor’s content package moving forward. Theatrical releases of movies create a different, higher level of perceived quality in the minds of consumers, provide greater opportunity for Distributors to market, and provide an additional revenue stream for those Distributors who aren’t already monetizing through theaters.

Expanding “movie theaters” into “must see content theaters” (obviously workshopping this name) will very clearly benefit Exhibitors, but do customers want it? In short, yes. Not only is there broad interest in theatrical content expansion across age groups (especially the vaunted younger demos):

But significant portions of the customer base say that they would actually pay premiums to watch such content in theaters (cue Part 2’s rate fencing take):

Again, the idea here is not to wholly displace major movie launches. Movies would continue to represent a majority of seats, screens, and dollars. But theaters now have the opportunity to diversify across three primary vectors that should improve their leverage with Distributors:

Content Type

Content Suppliers

Temporal Variety

Today first-run movie content represents close to 100% of theatrical revenues. This number should conceivably drop closer to 60-80% with a broader content programming initiative, stemming from an increase to both who attends and how often they attend.

Put differently, I suspect that this content expansion will cannibalize relatively little of the current movie launch business (say 5%) in exchange for a market expansion opportunity of 20-60% (saying nothing about the returns from the changes I already discussed in Parts 1-3).

Shifting from movies to must see not only diversifies programming, it further diversifies the supplier mix. As I previously mentioned, 88% of theatrical revenues today come from just seven distributors, but an expansion into streaming/television, sports, and music programming would knock down this concentration considerably.

Again, not to the point where the studios would represent a minority supplier position - not when they also represent a significant chunk of streaming and sports distribution rights - but it would nonetheless arm Exhibitors with a bit more leverage in this large shift.

Finally, this broader pool of “event content” not only provides the Exhibitor with content and supplier diversity but with temporal diversity. I’ve written at length about the abysmal seat utilization rates of the megaplexes, much of which come from the non-prime time Monday-Thursday (especially day time) slots.

Prime time television and sporting events naturally fill some of these midweek slots without disrupting the Friday & Saturday “movie nights”. Even HBO’s highest value programming slot (Sunday) provides a nice cap to each movie weekend.

Evolving the Revenue Share

It’s all well and good that content diversification would enable Exhibitors to evolve their theatrical product into one that better matches with current consumption patterns.

But as Exhibitors still today own no content (more on this in a moment), to make such a large shift to their content strategy requires the contractual sign-off of the very Distributors who hold all of the leverage today.

Why would they do so? How can Exhibitors ensure that Distributors would actually partner in this theatrical evolution?

Growing the Collective Pie

At present levels of demand, self-interested Distributors would (rightly) interpret “content diversification” as “less revenue for me”. This is the starting point - the goal of this endeavor, coupled with every other change we’ve made in this series, is to actually grow demand for the theatrical product in the coming decade or two.

And as I covered in Part 1, the self-interested nature of Distributors should find this work intriguing on its face, given their inability to replicate the combination of revenues and awareness (via stunted capacity for marketing spend) during the grand Pandemic experiment of 2020.

One of the major concerns Distributors have with large-scale price discrimination is that Exhibitors could - hypothetically - slash ticket prices and shift those prices instead to concessions, where there is no share of revenue.

Putting aside the inanity of this concern - as I’ve already shown, Big 3 Exhibitors earn nearly 50% of their gross profits from tickets and cannot conceivably increase concession prices by 50%+ as an offset - it is a concern nonetheless.

So I would posit here that Exhibitors can and should sweeten the pot here - by redefining the theatrical revenue share from admissions only to including concessions. Putting aside the obvious “hell no” arguments of the Exhibitors, the whole point of this move is to incentivize both parties to maximize theatrical revenues.

Placing both of the major theatrical revenue drivers into the pool removes any Distributor concerns about the pricing experimentation that is necessary for maximizing value.

Now, this necessarily requires a massive financial and cultural shift for Exhibitors specifically, given the 85% margins of concessions. It also potentially forces Exhibitors to take on all of the revenue risk here, given that they are the ones willingly giving up exclusivity to half of their current profits (and far more than half if we’re talking about smaller Exhibitors).

For this reason, Exhibitors should use this olive branch to further evolve the revenue share in two major ways that Distributors will most certainly reject out of hand but we will nonetheless posit here.

Removal of the Temporal Rev Share

Given that Exhibitors are now willingly offering Distributors access to a significant new revenue stream, and given that Exhibitors have already condensed the exclusive theatrical window to six weeks or less, it’s only logical that the temporal component of the rev share be removed.

That is, Distributors should no longer garner first week shares of 60-80% of revenues, then taper down thereafter. No, those days are gone. Instead, each initial theatrical run would incur a flat share of revenues. This would properly incentivize Exhibitors to, once again, maximize total revenues, rather than play the “margin capture” game that permeates operations today.

This change is certain to rankle Studio lawyers to no end, but it would be a (necessary) show of good faith to the concessions concession, and would enable better temporal price discrimination. My next suggestion would likely get Exhibitors thrown out of the conference room, but we’re already on a roll, so let’s do it…

Exhibitors Get a Piece of Streaming

Let’s walk through the logic here. We know that there is a significant correlation between streaming consumption and theater attendance, as patrons who see two or fewer films in theaters each year consume 42% less streaming content each week than those patrons who see at least nine films in theaters each year.

And as I already showed in Part 1, (successful) theatrical releases have a significant and measurable impact on the revenue generation of movies once they hit streaming:

Mind you the above data are simply for new movie releases. As I’ve already argued, theaters will be evolving away from exclusively movies to include must-see streaming content as well. Assuming these data hold, streaming consumption (and therefore streaming value) for the largest programs would grow as a result of the parallel theatrical push.

So there’s a tangible, measurable connection between theatrical-streaming consumption and revenue generation that ultimately is a (large) net positive for Distributors.

There’s also a precedent for this type of deal. As covered on the 99% Invisible Podcast The Megaplex, in the early stages of the Streaming Age, Premium VOD was the new “home video” opportunity that Distributors were toying with as they worked to both replace falling DVD revenues and weaken the long, exclusive theatrical windows.

To incentivize cooperation from Exhibitors, Distributors offered a revenue share of this window, which, in their myopic hubris, Exhibitors declined.

Well…it’s time to right that wrong here. Exhibitors killed the leverage they once had to demand better terms here, and they are (in this scenario) paying for this mistake by offering concessions as a necessary catalyst for claiming a piece of streaming.

Distributors would (rightly) argue that the “theatrical effect” is short-lived, and as such there must be a cap on the revenue sharing period per title. But the economical relationship between Theatrical and Streaming is too strong, and too direct, to avoid in discussions here.

A Return to Vertical Integration

Up to this point, I’ve attempted to make the case for two major changes that would reshape the partnership between Exhibitors and Distributors:

Evolving theatrical content away from movie exclusives and toward must see content writ large.

Expanding the revenue sharing agreement from purely admissions tickets to concessions AND streaming.

At the start of the piece I briefly outlined that the Paramount Decree was solely responsible for this Exhibitor-Distributor split in the first place, but I haven’t really commented on what it could/should mean now that the Decree has been invalidated.

Given the horrendous financial position of the Big 3 Exhibitors I outlined in Part 1, the most obvious option here is for the Exhibitor to sell; to fold itself into the money-gripping clutches of a Disney, Apple, or Amazon.

To head off the inevitable cries of “Studios owning theaters will crush competition and kill the industry”, please at least consider these broad findings of the Paramount Decree:

“Despite the popular belief, it seems fair to say that we do not find evidence that the Supreme Court ruling against vertical integration improved competitiveness in this industry and therefore we have grounds to doubt whether this was a real concern at all to start with.”

With that in mind, there are already rumors that Amazon/Bezos have looked into buying AMC, and I’m frankly surprised we haven’t heard more (yet) on this front. Perhaps this is just a waiting game - waiting for Exhibitors to fall into bankruptcy where their bones can be picked clean.

The far juicier scenario is the opposite; for Exhibitors to be acquisitive, picking off the largest indie Distributors or perhaps even the smaller majors. Now, it’s absolutely impossible without a broad resetting of the balance sheet, but let’s assume for a second that the major Exhibitors do in fact adopt my cost-resetting suggestions.

What the “vertical integration” strategy would accomplish is providing both a guaranteed content supply for more favorable/flexible rates AND a diversification of the Exhibitors’ revenue streams, derived from high-margin content licensing. That is, rather than be driven to irrelevance by the Streaming Age, Exhibitors could actually profit from it.

Conclusion

I started this series with an admission of bias; that I am/was an avid moviegoer, and I very much wish for this product to persist. I’m also a capitalist, operator, and investor, and the last thing we need is more subsidies to prop up dying businesses.

What I’ve attempted to demonstrate is that although movie theaters can never be as popular as they once were, the business should be far larger, can return to growth, but only if the theatrical business’ major purveyors fundamentally evolve what and who they are:

Theaters are heavily overbuilt, need to be cut down to meet demand, and this downsizing, though painful in the near-term, will significantly relieve balance sheet pressure to enable further investment in theatrical evolution.

Implementing scaled price discrimination with more targeted subscription offerings represents a no-brainer profit maximizer and behavioral incentive to better capitalize on the various price elasticities of different customer segments.

Both the physical and digital interfaces with customers are of unacceptable quality and must be fundamentally improved for any secular growth to return.

Must-see content has sufficiently transitioned beyond movies and theaters must thus evolve their programming to better meet current demand.

None of these norm-shattering programming changes are possible without a refactoring of the distributor/exhibitor revenue share.

I’m least confident in this last one because, well, powerful, homogenous executives are incentivized, individually and collectively, to posture and maintain rather than progress.

That said, if the capitalist piece of their collective brains can overwrite ego and actually seek to maximize total returns, we will see shifts in this domain. What I can absolutely guarantee, however, is that the current trend toward irrelevance, accelerated by the Streaming Age, will continue unabated if Exhibitors do not take immediate, paradigm-shifting steps to evolve their product and business.